If you’ve been in Singapore the past few years, you’ve probably noticed two things: your grocery bill has gone up, and your mortgage repayments back at home might have too. Interest rates and inflation don’t just impact big economies – they hit everyday expats in very real ways.

The challenge? These two forces often work together to squeeze your finances from both ends. Inflation erodes your purchasing power, while higher interest rates increase the cost of borrowing. But with the right strategies, you can protect yourself, and even find opportunities.

1. How Interest Rates & Inflation Work Together

• Inflation: Prices rise, your money buys less.

• Interest Rates: Central banks adjust rates to try to control inflation, which impacts loan costs and investment returns.

• For Expats: You might be earning in SGD, paying loans in another currency, or vice versa…meaning you face multiple layers of impact.

2. Impact on Mortgages & Loans

• Floating Rate Loans: Your repayments can rise quickly as interest rates climb.

• Fixed Rate Loans: Offer short-term protection but may revert to higher rates later.

• Multi-Currency Loans: Add currency risk to the mix; a weakening home currency can make repayments more expensive.

If you’re planning to be in Singapore for several years, explore refinancing or partial prepayment to lock in manageable terms.

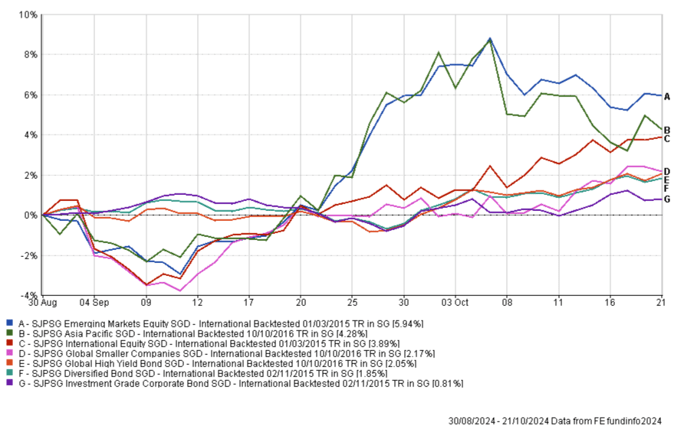

3. Investment Strategies in High Inflation

• Equities with Pricing Power: Companies that can pass increased costs to customers.

• Inflation-Linked Bonds: Adjust payouts based on inflation rates.

• Real Assets: Property, REITs, and infrastructure funds often provide inflation protection.

• Shorter Duration Bonds: Less sensitive to rising rates than long-duration bonds.

4. Cash & Emergency Funds

• Keep enough liquidity for safety (3–6 months of expenses), but avoid holding excessive cash, as inflation will erode its value.

• Consider short-term fixed deposits or money market funds for better returns without high risk.

5. Currency Management

If you’ll eventually move your money to another currency (for retirement or repatriation), inflation and interest rate differences between countries matter.

• Diversify across currencies.

• Use hedged share classes for global funds where appropriate.

6. SRS & Long-Term Planning

When rates rise, bond-heavy SRS portfolios may underperform. Consider:

• Increasing equity exposure if suitable for your risk tolerance.

• Adding assets less sensitive to rate hikes.

Interest rates and inflation don’t need to derail your financial plans. By actively managing your loans, investments, and currency exposure, you can turn economic headwinds into manageable breezes, and even use them to your advantage.