The need for cyber security has become paramount in today’s modern age, particularly in the fintech and financial space. Being in this industry myself, I handle sensitive client data daily, and have access to their online wealth accounts; it is therefore vital that their information stays safe and inaccessible to fraudsters. Robust security measures must be in place, and I am constantly having to upgrade and refresh my skills to keep my clients safe.

Whilst fintech has allowed for financial services to become more streamlined, convenient, and efficient, it has somewhat opened the floodgates for cyber-attacks and threats. Harvard Business Review reported a 20% increase in data breaches from 2022 to 2023, and this is set to increase further as the years progress. Not only does this mean we have to constantly upgrade our software and infrastructure, but human area can become a massive opportunity for cyber criminals. I truly believe that a two-pronged approach of new regulatory processes, along with using AI in cybersecurity is a dynamic tactic to tackle this ever-evolving problem.

Cyber security is now seeing the same level of regulation as every other type of security, which means that fintech companies in particular must adhere to stringent rules and procedures. Regulations such as the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS) must be followed. Whilst of course this is best practice to ensure that clients’ data is safe, it therefore adds an extra strain onto the company and its employees; this may lead to delayed admin processes, longer lead time for new business submission and therefore, a time delay in profit for the company. Time is money, and the longer it takes for profit to be made, it essentially means smaller margins for the company.

One way this can be tackled is with Artificial Intelligence. Whilst using manpower takes time and money (not to mention the risk of human error), AI systems can scan masses of data sets, analyse data, spot anomalies, and therefore detect possible cyber risks before they have even happened. This preventative method ensures that risks are managed efficiently, and before they become breaches, which means a safer system for the clients, and mitigates possible reputation risk for the company.

However, AI is not a final solution; with cybercriminals’ techniques ever evolving, it means that AI will have to do the same. Not only that, employees must keep re-training when new systems are introduced, to ensure that human error is kept to a minimum. Moreover, one must ensure that the third-party companies engaged to deliver this AI system, is also compliant, safe, and follows the stringent regulations set in place for fintech companies to adhere to.

But the buck doesn’t just stop with the company- clients and customers must also stay vigilant so that they don’t fall victim to cyber-crime. For example, being able to spot a phishing email, not clicking on unknown links, and not giving out all your banking details to someone over the phone. In order for an individual to be savvy, particularly when it comes to fintech and online financial transactions, they must be aware of risks and know when and where it is appropriate to give out their financial information. If you engage a professional for your financial planning, of course you will have to make them aware of your personal details and possibly even bank details. But do take note that they should be encrypting or password-protecting any sensitive documents that are being sent to you.

Even if you are planning your finances alone, and are using platforms for your investing, be sure to do your own due diligence; ensure that the apps you are using are regulated and have secure payment systems. Do take note that most will require you to upload some form of identification, as well as declaring your tax residency. Whilst to a layman, this may seem intrusive, this is actually a sign that the platform is doing its part to adhere to compliance and regulations. If they don’t ask of these from you, it could be a sign that the platform is not regulated.

For those that plan their investing and finances alone, cybersecurity becomes an even bigger risk, as this is normally something that a large corporation would have to ensure the safety of first, but now it is being left to the individual investor. If you are considering planning your finances yourself, having basic understanding and knowledge is incredibly important. Therefore, I often suggest that people understand four main areas before they start investing, which I will explore further in this article.

Finance 101

I have many clients and connections that I come across asking me for advice on how to get their finances in order. ‘How can we maximise what we have now, so that we can make the most of our money later?’. Of course, one of the best passive things we can do, is to invest.

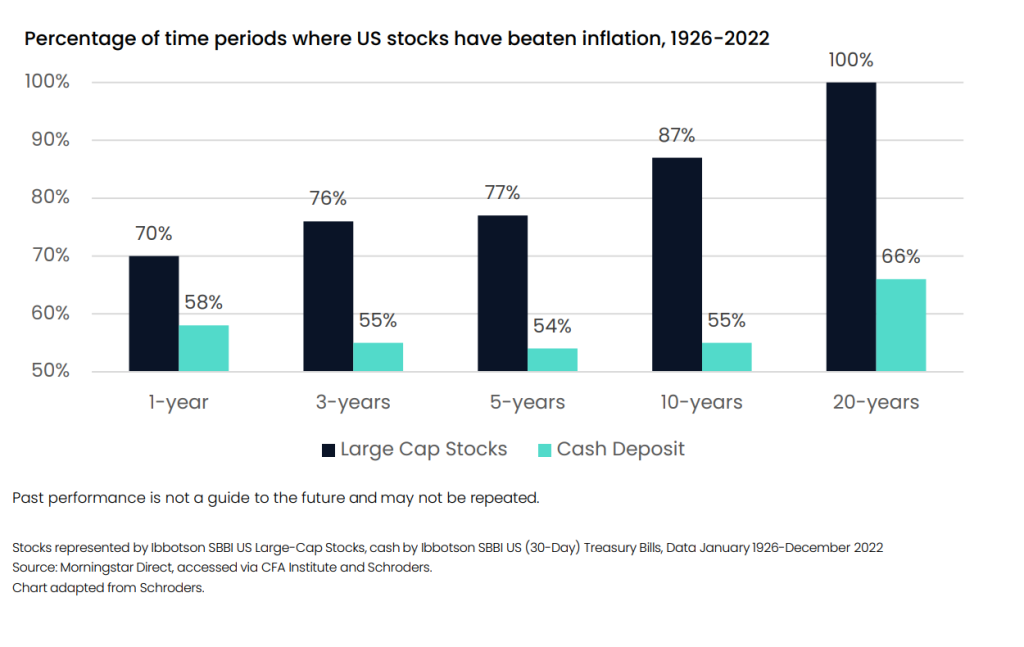

Investing is the concept of allocating assets, usually money, into different financial vehicles to create a profit. The bare minimum investment should be doing is beating inflation, because over time our hard-earned money is worth less, due to the rising cost of products. Before one starts investing, it is best to have a clear strategy, and get the basics covered first. Here are a few key financial areas you should have planned for:

- Build an Emergency Fund

At a glance investing may seem like an obvious choice when it comes to saving money. Why not just throw all your savings into investment if it means high returns? The answer is that investment returns are NOT guaranteed- even the safest investments come with some risk, and sometimes the lock in periods are high, or the penalty for withdrawing early is expensive. To ensure that you are not over-investing, make sure that you have an emergency savings fund that is easily accessible. That way should an emergency arise (like a large hospital bill or having to pay for car repairs), you can use your emergency money instead of jeopardising your investments.

The recommended amount you should have in your emergency fund is 3-6 months of your monthly salary. This should be a healthy buffer should the worst happen. If you already have more than that, then that’s a great time to consider investing.

2. Know How to Budget

Of course, setting aside for investment would be impossible if you didn’t know how much to set aside. That’s why organising your budget is a crucial step in your financial planning. There are many ways and methods for planning, but a good starting point would be the 50/20/30 rule:

- 50% of your monthly salary maximum should go on things you need to pay for: housing, bills, groceries & insurance.

- 30% can go on doing the things you enjoy: hobbies, drinks and travel.

- 20% should go into your savings: think about your long term savings and investment goals.

If you have surplus each month, you can even consider increasing this 20% to a higher proportion, and allocate more into your investment goals.

3. Be Debt-Free

Before you do any investing, you should really consider paying off your debt. Having a credit card bill is fine, but having any large or bad debt will hinder you in your long-term goals. It seems counter-productive attempting to make lots of money with investments, whilst paying off lots of debt. It may be difficult paying off student debt or large loans, but you will reap the benefits in the long run when your debt isn’t eating into your assets.

4. Set Your Investment Goals

This is arguably the most important step, defining your goals. What is the reason for investing? If you are doing it out of pure greed, then your judgment will become clouded when it comes to riskier investments and you risk losing it all. So have a long and hard think about why you want to invest. You are putting your money, that you worked hard for, somewhere that could give you high returns, or give you nothing. Therefore, it’s best to have a long think and define some clear goals for your future. Do you want to plan for your retirement? Save for a house? Pass something on to your children? Whatever it is, decide how much you would need and by when. Most investments give better returns if you have a longer-term commitment, so it’s OK to think big. If you have no clue and are just investing for the sake of it, you will quickly lose your drive and passion for making money.

These steps may seem simple, but they really are the key to an effective investment strategy. I work with clients every day to ensure that they have budgeted correctly, serviced their debt and built an emergency fund, and together we work together to work towards their financial goals. Many find that this is more complex than they first thought and will include tax planning and ensuring that their assets are protected. This is of course one of the added benefits of hiring a professional. If you feel that these services are something you would require, feel free to reach out at via my contact page!