We are all waiting on baited breath for the results of the US Election. What will the result mean for us as investors? Let’s take a look at a Macro Outlook overview & some key points to take note.

Macro Outlook

Attractive Valuations

• Asian Emerging markets are currently offering more attractive valuations compared to U.S. and other developed markets.

• These attractive valuations present a cost-effective entry point for investors seeking growth opportunities.

Declining Inflation and Interest Rates

• Recent trends indicate a decline in inflation rates across many emerging markets. This trend is expected to lead to lower interest rates over the next 18 months to two years.

• Lower interest rates can stimulate economic growth by making borrowing cheaper, which can boost consumer spending and corporate investment.

Weakening U.S. Dollar

• A weaker dollar can improve trading conditions for emerging market economies by making their exports more competitive on the global stage.

• A weaker dollar can attract foreign investment capital, as returns from these investments may be amplified when converted back into stronger currencies.

Bond Market Opportunities

• Yields continue to be elevated as compared to pre-2022, at the top of its percentile throughout history.

• With interest rates stabilising, fixed income, which exhibits 1/3 the volatility of equities, can act as a defensive portfolio diversifier, and an investor can lock in current yields at above average levels.

• With higher starting yields, expected forward returns are consequently higher and the correlation and statistical significance is high.

• In this Fed pause cycle, yields have fallen lesser than average, and a mean reversion would see a larger potential for capital appreciation.

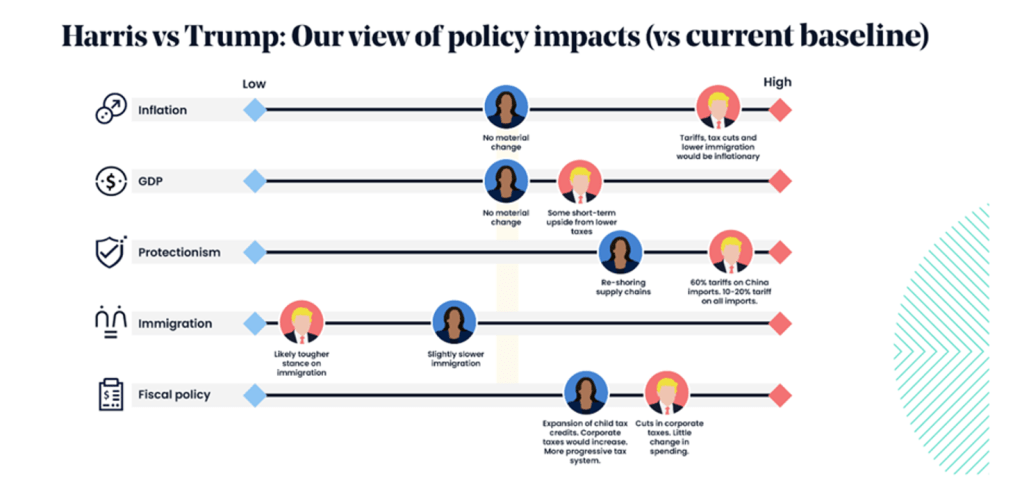

What If Trump Wins?

I was going to include ‘What If Harris Wins?’…but it seems like that probably won’t be the case! So what happens if Trump does win?

•Trump’s policy around trade tariffs, tax & immigration would be inflationary.

•There would be less interest rate normalisation, as the Federal Reserve may not be able to cut interest rates as rapidly.

•Reflecting on Trump’s previous presidency, high yield bonds & stocks outperformed due to favourable policies, which were pro-business and pro-markets.

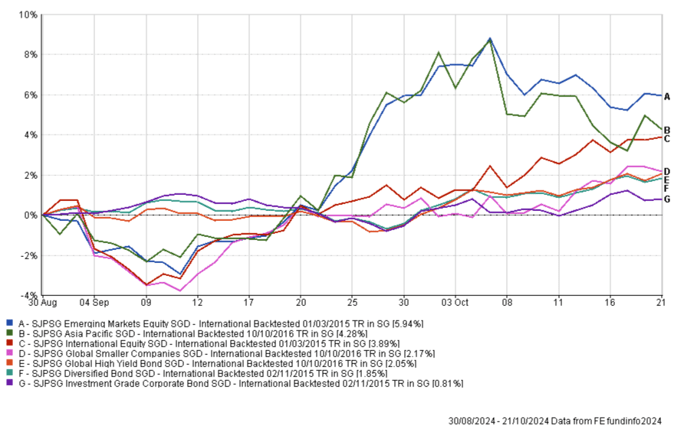

• During his last election, in November 2016, small caps in those initial months performed well, double the performance of the S&P 500.

Graph above shows Small Cap ETFs in 2016

Investment Opportunities

· Many emerging market assets have been undervalued in the past, providing a compelling entry point for investors. By reallocating funds into EM/Asia funds, we can capitalise on these undervalued opportunities, positioning ourselves for substantial growth as these markets normalise.

· In addition, high yield bonds are less sensitive to inflation and have a current distribution yield of 7.8%.

A Tale of Two Halves: After the Fed rate cut, we see an uptick & opportunity in Asia & EM. We also see a stable & resilient Global High Yield Bond.