A recent study by the Ministry of External Affairs Consular Services showed that NRIs (non-resident Indians) make up 24% of Singapore’s ‘non-resident’ population, which is currently at 1.4 million. Even though this group is referred to as ‘non-resident’, they are living and working as professionals in Singapore. This means that they are not considered as tax residents in India. Many of my clients come from this demographic, and as such, I felt it would be best to share some of the topics we discuss, namely, what they can do whilst they are living and working in Singapore to make the most of their time here.

- Saving

I will admit that Indian bank accounts have great interest rates- general public interest rates can be as good as 7.85% per year, and this often puts many NRIs off saving or even investing in Singapore, because they feel that the rate of return is low in comparison. However, there are many factors that have to be considered, which I believe makes Singapore a good place to build wealth. The first is that the Singapore Dollar is a stable currency. INR continues to depreciate against SGD by 3-4% per annum, with an inflation rate of 5.69%, meaning that rupees purchasing power will become less and less as the years go on, meaning that saving in INR and Indian bank accounts may not be as beneficial in the long run. The SGD is among one of the few stable and most traded currencies globally. It is regarded as a safe haven asset that also hedges against currency risk.

Not only that, the Singapore banking system is not only safe but simple; the Monetary Authority of Singapore esures tight regulations, but it doesn’t mean more bureaucracy. It is quite simple to transfer money around or even overseas from Singapore. This is in contrast to India, where there are still a lot of tedious processes in place, especially when it comes to selling a property as an NRI, or moving money out of the country.

2. Tax Relief Opportunities

This may be one of the most attractive reasons for NRIs to plan their finances in Singapore. There are many different kinds of taxes in India, whether that be direct or indirect. Direct taxes include things like income tax, capital gains tax or gift tax, with indirect tax including customs duty, value-added tax and service tax. This tax-heavy system can eat into your bank interest rate or your investment rate of return. In Singapore we have no capital gains tax, low income tax in comparison to other countries, and lots of tax reliefs, such as the SRS scheme (check out my articles on this topic here https://danielleteboul.com/2023/08/10/why-should-expats-open-an-srs-account/).

Source:

New Delhi,UPDATED: Feb 1, 2023 14:14 IST

3. Investing

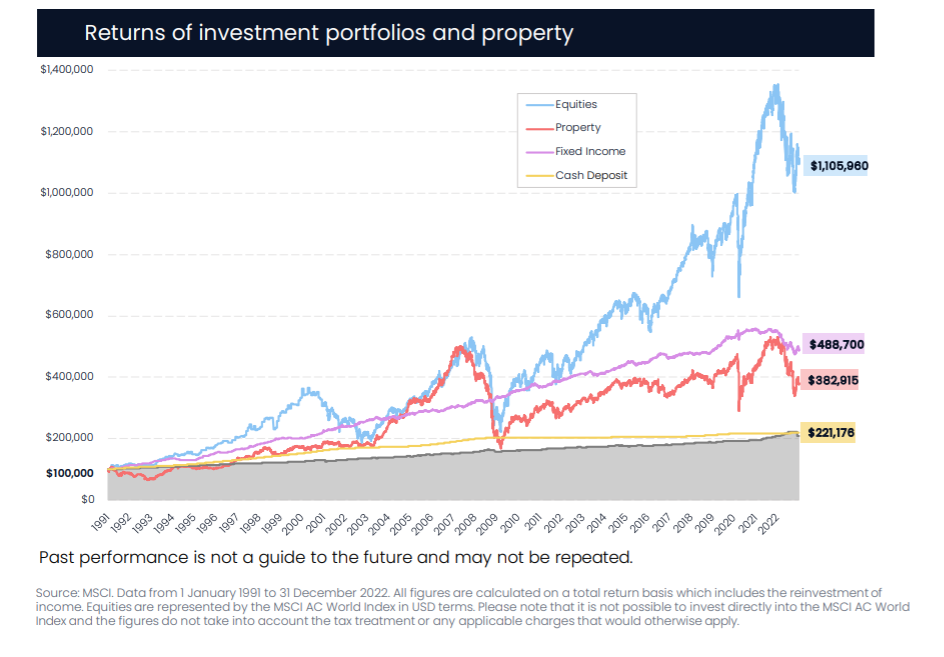

Speaking of capital gains tax and SRS accounts; there are many great investment opportunities here in Singapore. For example, in India, offshore funds are restricted. This means that many clients I encounter have excellent domestic portfolios (and don’t get me wrong, India is one of the champions of emerging markets, so it’s a must in someone’s portfolio!) but it is not diversified in terms of geographical location. Not only does that increase your investment risk, but it also means that you as an NRI are only having a small piece of the pie. In Singapore, so long as it is regulated and approved by MAS, you are not restricted to the funds you have. You can have access to regional, global, US, European, emerging market funds. And all of this is incredibly convenient, flexible and cost-effective. It’s pretty much the best of both worlds because you have the safety of Singapore, with the unlimited upside potential of global assets.

4. Being Of NRI Status

Being an NRI definitely has more perks than being a tax paying resident in India, such as all the previous things I have mentioned. Not only that, it means that whilst you are an NRI, you do not have to pay taxes on foreign investment or gifts received from relatives. This of course changes when you are back to being a tax paying Indian resident, with 20% tax on foreign capital gains. This is why it is crucial to make the most of your NRI status whilst you are earning in SGD. Ideally, you can build up a nice pool of assets and savings whilst overseas, and then once you retire or settle down in India, you can plan your finances accordingly following Indian tax ruling. The fact is that not every Indian will get the chance to become and NRI, and the Indian government has allowed many concessions for NRIs living and working overseas, to encourage globalisation. It is best to make the most of being an NRI, enjoying the stable and strong currency of SG, whilst enjoying offshore investment returns.

At the end of the day, we cannot avoid tax, and with many NRIs (60%) still preferring to retire in India, tax is inevitable. But, there is a window where this doesn’t have to be the case. Singapore is a capital gains haven! Why would you pass up on that opportunity!