If there’s one universal truth in expat life, it’s this: the admin is never-ending.

You can be thriving in your career, juggling two currencies, planning investments across borders… and still end up drowning in PDFs, renewal emails, HR benefit summaries, and three different insurance policies you vaguely remember buying but can’t quite locate. Add on the “free” protection that comes with credit cards or company packages, and suddenly your life admin becomes a full-time job.

As someone who works daily with expats on their financial planning, I see this chaos all the time. Clients come to me with folders of mixed paperwork, half-complete coverage, overlapping policies, and sometimes, gaps they didn’t even know existed.

Our expectations for banking and investments have evolved massively. We track expenses from our phones, invest with a swipe, and send money globally in seconds.

So why doesn’t insurance feel the same? Why is the most important safety net in our lives stuck in a world of PDFs, policy jargon, and patchy visibility?

That’s why I’m genuinely excited about what forgettable is building.

The App That Simplifies Life Admin (finally)

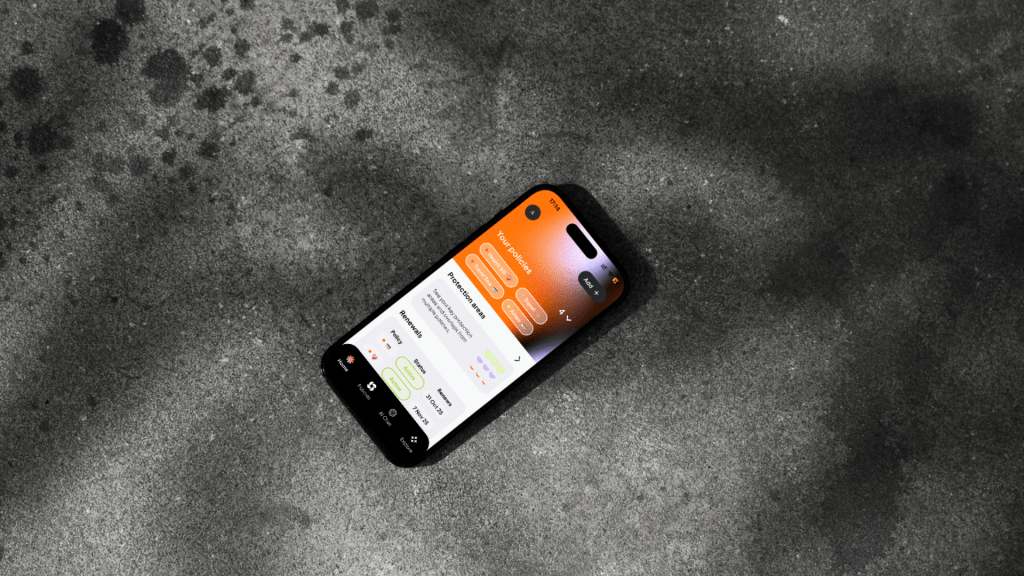

Forgettable is a Singapore-based insurtech built for Millennials and Gen Z, but honestly, anyone who has ever sighed at a policy document could benefit. Their approach is simple: to help people actually see and use the protection they already have, before topping up with anything new.

The platform:

Turns messy PDFs into smart digital cards: Upload your policies and Forgettable transforms them into clean, visual summaries that show exactly what you’re covered for. No jargon. No fine print scavenger hunts.

Surfaces protection from your credit cards & work benefits: Most people don’t realise how much “free” cover they already have. Forgettable pulls those benefits together so you don’t miss perks you’re already paying for.

Shows overlaps, gaps, and total insurance spend: This is a big deal. Insurance planning shouldn’t be guesswork. With everything centralised, it becomes instantly clear where you’re double-paying, under-protected, or perfectly balanced.

Visualises claims, limits, and geographical coverage: Especially for expats, knowing where your cover applies is crucial. Forgettable helps you understand your protection geographically, Singapore, home country, travel, and where the blind spots are.

In short: It’s life admin, but easier. It’s insurance, but finally modern.

Clarity = Confidence abroad

One of the biggest emotional undercurrents I see in expat financial planning is uncertainty. We’re far from home. Our systems are different. Our support networks shift. Insurance is one of the few tools that gives people stability and confidence, but only if they understand what they have.

Having everything centralised not only helps clients make better decisions, it also empowers them with knowledge. And when someone understands their foundation, they’re far more prepared to build on it; whether that means topping up critical illness, adding maternity riders, or planning long-term medical insurance as a foreigner in Singapore.

Why I’m sharing this

I don’t often highlight specific platforms, but I think forgettable is solving a very real pain point, especially for expats who already juggle more admin, more uncertainty, and more moving pieces than the average person.

Anything that helps people gain clarity, save time, and make smarter decisions about their protection is a win in my books.

If you’d like to explore forgettable, , their website is http://forgettable.ai [forgettable.ai] &

their recent features and direction have also been covered in:

– E27: https://e27.co/forgettable-insurance-startup-20251024/ [e27.co]

– Tech In Asia: https://www.techinasia.com/startup-demystify-insurance [techinasia.com]

– The Straits Times: https://www.straitstimes.com/paid-press-releases/a-new-app-just-launched-and-it-fixes-the-one-thing-youve-been-ignoring-insurance-20251015 [straitstimes.com]

And of course, if you ever want help understanding your insurance planning or how your existing coverage fits into your wider financial goals, I’m always here. Because the right insurance should protect you, not confuse you.