I’m going to start this article with a controversial opinion; I don’t think Friends was actually that good. I much preferred the crossover storylines & humour of Seinfeld, and I didn’t think it was as ground-breaking as Sex And The City. However, I will say that Friends did explore very important topics, one of them being money.

This show really highlighted the relationship between friends, work, money and how each character dealt with these situations. So I thought, seen as I’ve done The Simpsons, Sex And The City, and Seinfeld, it would be cool to analyse each character and how they behave with money. Of course, we are going to explore topics about rent (like how the hell did Monica and Rachel have that huge apartment in NYC!), careers, and if I think each character was good at saving and investing.

Chandler Bing

Chandler is a great character to analyse financially. Although his career is a big vague (something in IT management?), we see his career grow significantly, to where he is considered a higher income earner. Some articles say his salary would have been roughly USD 100,000 per annum, with others saying up to USD 180,000. I can imagine that this corporate role of his gave great benefits; probably health insurance, bonuses and maybe even contributions into a 401K. This would mean that Chandler would have a good capacity to save- a high income with less fixed expenses. And we can see that throughout the show, mainly when he does a mid-career switch and becomes an intern. This would mean that he would have taken a massive pay cut, but that doesn’t seem to phase him. This tells me that he had enough saved up in his emergency fund to be able to still cope, even on a lower salary. The only red flag Chandler has when it comes to money is his willingness to loan a friend cash without expecting it to be repaid. He lends Joey a lot of money, and covers a lot of his expenses, and I don’t think Joey pays it all back. To me, this shows that Chandler has a blurred line between logic and emotion, particularly with money. He could have learnt to either say no to Joey, or set some expectations as to when and how he would like to be repaid.

Rachel Green

Rachel’s career development throughout the show is very interesting. She starts off as a runaway bride from a rich husband, and we know her family is well-off, but she gives all that up and becomes a barista and waitress at Central Perk. It’s difficult to estimate her salary at this point, because wait staff do not qualify for minimum wage in the US; their base salary is very low and the rest is tips. Whilst tipping culture in the US is huge, one could argue that Rachel may not have been getting a lot of tips. She isn’t great at her job and often messes up orders. Moreover, Central Perk is a cafe, not a fine-dining restaurant, so the tips in general wouldn’t been as high as other establishments.

By the end of the show, she works in fashion, pulling a salary of roughly USD 55,000. I’ll explain later that her fixed expenses in terms of rent would have been very low. However, something tells me that Rachel’s expenses would have increased with her income; she doesn’t duplicate an outfit, and we see her with some designer pieces too. Although her job at Ralph Lauren would have given decent benefits (similar to Chandler), I think her lifestyle expenses would be more.

I’m unsure whether Rachel would be investing, as well as saving. She is hard-working, but she can also be spontaneous, which leads me to believe there’s not a tonne of forward-planning going on. She comes from a well off background, so there is a chance that her parents may have taught her the importance of investing, or she may have been completely sheltered from it.

Ross Geller

Maybe another controversial take- I cannot stand Ross. He has that toxic ‘nice guy’ trope, he doesn’t treat Rachel well and my biggest gripe is his job as a Palaeontologist. As someone who has a BSc (Hons) in Palaeobiology & Evolution, and an MA in Palaeolithic Archaeology & Human Origins, I can tell you right now that Ross’ job doesn’t make any sense. His lectures often cover non-palaeontological topics such as geology and sedimentology, and he often talks about his research in anthropology. These are all different things, and a lecturer would not be trained in all of these areas, or be hired to give lectures on all of them! Another point that always confused me is that Ross is portrayed as a higher income earner, with his salary being estimated at USD 75,000 a year. I know it’s very different to the US than in the UK, but I know for a fact that in England no palaeontologist would earn that amount.

But it’s not all peachy for Ross- he has a LOT of expenses; he’s the only one out of the six that lives alone, which means that he’s covering the rent by himself. He also has two kids and is three times divorced, which means that he would have a lot of outgoings in terms of child support and alimony.

Monica Geller

Monica has very good financial standing in the show. A head chef would have been pulling a salary of approximately USD 80,000 a year. Chefs have to work long hours, which would mean less time to spend money on going out. Not only that, if you work in a restaurant, it’s very common for your food to be covered, meaning that Monica wouldn’t have a tonne of expenses going out each month. Now let’s talk about the apartment. That place was huge, and we all know that New York is super expensive, even back in the 90s. So how did Monica (and Rachel) keep up with rent every month? It’s mentioned in the show that the apartment originally belonged to her grandmother, and when she moved away, Monica began living there and started subletting it out (illegally). This apartment was rent-controlled, so the rent would have only been USD 200! This would have been so cheap when spilt between her and Rachel, meaning that Monica’s living cost would have been very low indeed.

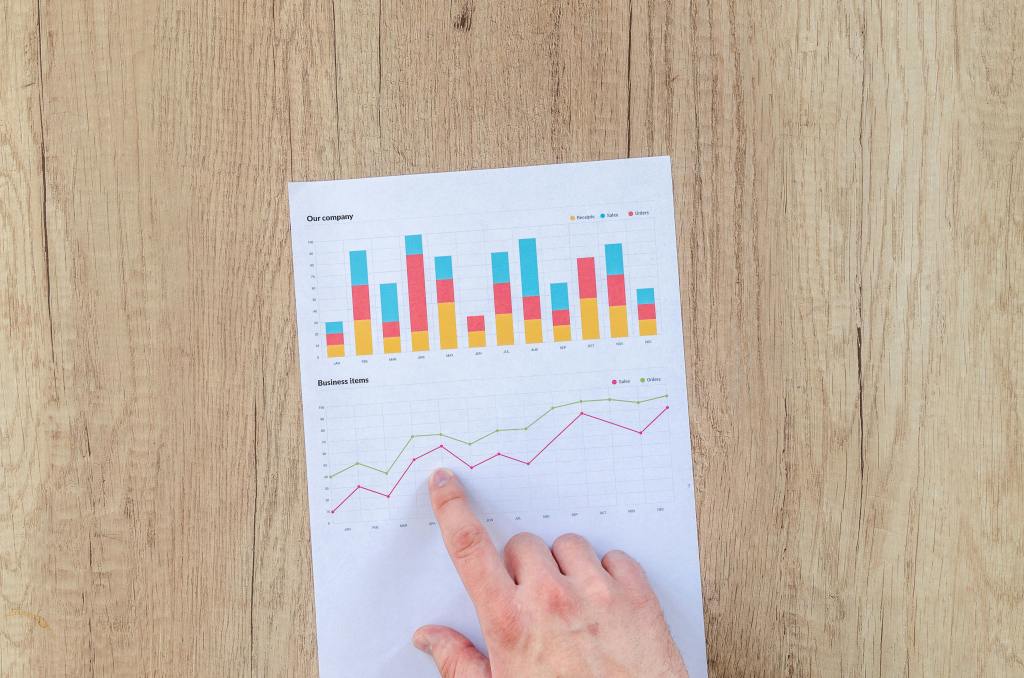

Moreover, Monica has quite an organised, cautious and responsible personality. This tells me that she was provably a prudent saver and investor, and she probably would have been investing in cautious portfolios. This would mean that sh’e likely be seeing moderate returns of 4-5%, meaning that her money would have been out-performing inflation. Therefore, Monica would be well set up for future kids’ expenses, and retirement.

Phoebe Buffay

Arguably the lowest earner out of the bunch, Phoebe’s salary is very difficult to estimate. Like Joey at times, we see her doing lots of various odd jobs, such as free lance caterer, busker, or a masseuse. A masseuse in the 90s could have drawn a salary of roughly USD 50,000. So at times when Phoebe’s salary was consistent, she could have been managing ok. Moreover, she lives with her grandma, meaning low fixed expenses, and she even inherits this property when her grandma passes. Whilst this would mean additional costs, such as maintenance and various taxes, that would be a huge boost for Phoebe’s assets. Other than this, I get the feeling that Phoebe often lives paycheque to paycheque, and therefore not a lot of space for savings and investing.

Joey Tribbiani

Joey’s character I think is the most interesting to explore. Throughout the show, we see Joey’s professional career as an actor- a job which is not always consistent or full time. And because of this, we often see Joey going through bouts of unemployment, or doing odd-jobs. However, by the end of the show, he is arguable earning the most out of the six, with his annual salary estimated at around USD 130,000. One thing I like about Joey is that, although his salary massively increases, his lifestyle doesn’t seem to change a tonne; he stays living in that apartment for the most part, he still enjoys home cooked Italian food or take-out, and we don’t see him spending too much on frivolous luxury items.

Another positive portrayal in the show is the bond between him and his family. They seem incredibly supportive of him, and value quality time together. Coming from a Mediterranean family myself, I can imagine that Joey’s culture and family dynamics contributed a lot to his money habits. From personal experience, immigrant families tend to have very strong work ethics, understand the importance of saving and realise that there are non-material ways that you can feel rich. I’m sure a lot of these mindsets rubbed off on Joey, but one thing about him that isn’t so good is the fact that whilst he is out of work or doing odd-jobs, he often relies on Chandler for financial support. Chandler not only covers his rent and food on several occasions, but he also pays out of pocket for Joey’s hernia surgery, which if you know anything about the US healthcare system, you know that it’s really quite costly! A fan estimated the amount that Joey owes Chandler, at a whopping USD 101,760!

All in all, Friends is a great portrayal of a group from various income brackets, with characters with many different money mindsets. We can learn a lot from them, such as the importance of setting aside for a rainy day, minimising our fixed expenses, and how to deal with friends in different money situations to us. I’ve really enjoyed doing this financial deepdive into the show, but I’d like to move away from US (particularly NYC) based shows! So please give me some suggestions for the next ones!

References:

https://www.bustle.com/entertainment/friends-characters-salaries-earned-throughout-series-estimated