Today, we’re diving into a crucial topic for expatriates navigating the complex world of investments: how to tailor investment strategies based on risk assessment and portfolio diversification. Whether you’re living abroad for work, adventure, or retirement, understanding your financial goals and risk tolerance is key to building a successful investment portfolio. I have written many articles in the past that talk about risk tolerance & diversification, so let’s look at it in a bit more depth today.

Understanding Risk Tolerance:

This is essentially how much risk you’re willing to take with your investments. It can vary widely from person to person and is influenced by factors such as age, financial situation, investment experience, and personal comfort with market fluctuations. Generally, someone that has a longer investment horizon, can tolerate more risk than someone who is planning on withdrawing their funds in a couple of years.

For expats, risk tolerance can also be shaped by their unique circumstances. For example, if you’re living in a country with instability, such as job insecurity, you may prefer safer, more conservative investments. Conversely, if you have a stable income and are decades away from retirement, you might be open to more aggressive investment strategies.

To assess your risk tolerance, consider asking yourself these questions:

- How would I feel if my investments lost value?

- What are my financial goals for the short and long term?

- How much time do I have to recover from potential losses?

Setting Financial Goals:

Once you have a clear understanding of your risk tolerance, the next step is to define your financial goals. Are you investing for retirement, purchasing a home, or funding your children’s education? Each goal comes with its own timeline and risk profile.

For example, if you’re saving for a child’s education in ten years, you might choose a balanced approach that combines growth-oriented equities with safer bonds. On the other hand, if you’re looking toward long-term retirement savings in 20 or 30 years, you could lean more heavily into stocks for potential growth. This is why it is key to understand what goals you have, and are simply not investing for the sake of it, as you can lose sight of your reason why, and panic during certain market conditions.

Portfolio Diversification:

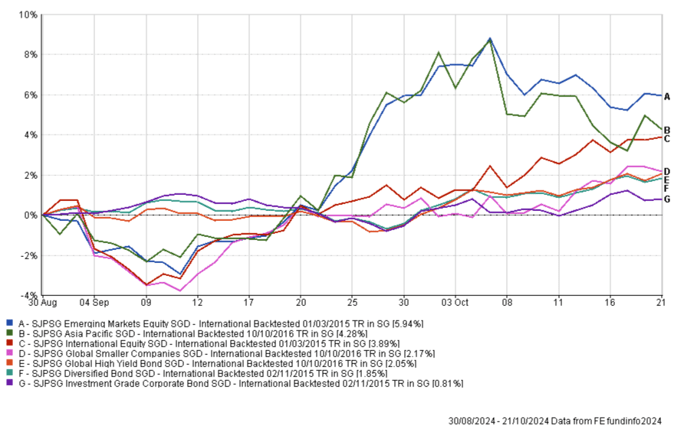

Now that you understand your risk tolerance and financial goals, let’s discuss portfolio diversification. Diversification is the practice of spreading your investments across various asset classes—such as stocks, bonds, real estate, and commodities—to reduce risk. For expats, diversification can also mean considering international investments that reflect the global nature of their lives.

Here are a few strategies to consider:

- Asset Allocation: Determine the right mix of assets based on your risk tolerance. A conservative investor might have a portfolio that is 60% bonds and 40% stocks, whereas a more aggressive investor could flip that ratio.

- Geographic Diversification: As an expat, you might be exposed to multiple currencies and economies. Investing in different regions can help mitigate risks associated with a single market. For instance, consider investing in both your home country and the country where you’re currently residing.

- Sector Diversification: Within your stock investments, aim to include a mix of sectors—such as technology, healthcare, and consumer goods—to protect against sector-specific downturns.

- Consider Local Regulations: Depending on your host country, there may be specific investment vehicles available to you, such as tax-advantaged retirement accounts or local mutual funds. For example, in Singapore you have access to SRS & specific funds within that account, that will help with minimising tax. However, you will not be able to contribute to other schemes whilst overseas, such as UK ISAs or Pensions. Familiarise yourself with these options to optimise your portfolio.

In conclusion, investing as an expat can present unique challenges, but with a clear understanding of your risk tolerance and financial goals, you can develop a tailored investment strategy. By diversifying your portfolio across various asset classes, geographic regions, and sectors, you can mitigate risks and position yourself for long-term success.